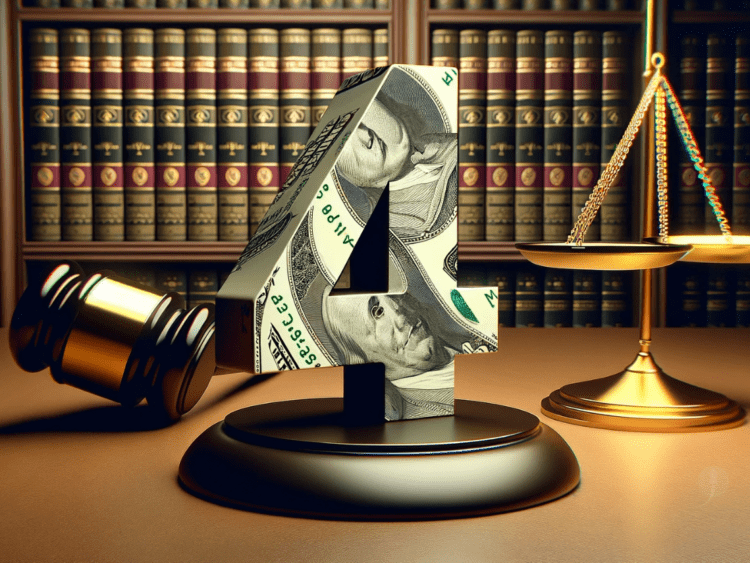

In a pivotal move for the cryptocurrency world, Binance, the largest crypto exchange by volume, has reached a comprehensive settlement with U.S. authorities. The agreement resolves long-standing issues related to registration, compliance, and sanctions. This development, involving a hefty $4.3 billion fine for violating sanctions and money-transmitting laws, is a significant step towards regulatory compliance in the crypto industry.

Solid Fundamentals Amidst Regulatory Compliance

Despite the legal hurdles, Binance affirms the strength of its operations. The platform boasts the world’s largest trading volume and assures its users of a secure experience, with a firm policy of 1:1 backing for user assets. Importantly, the U.S. regulatory resolutions do not imply any misappropriation of user funds or market manipulation by Binance.

Leadership Change at the Helm

Changpeng Zhao (CZ), the visionary founder and CEO of Binance, has stepped down, marking a new era for the company. Richard Teng, formerly the Global Head of Regional Markets at Binance, takes over the CEO role. Teng’s rich background in financial services and regulatory compliance, with stints at Abu Dhabi Global Market and Singapore Exchange, is expected to steer Binance through its future challenges and growth.

Crypto Industry Outlook: Resilience and Growth

Despite the regulatory turmoil and a bear market, Binance has crossed the impressive milestone of 150 million registered users. This growth underscores the exchange’s resilience and the burgeoning appeal of cryptocurrencies worldwide.

Market Dynamics Post-Settlement

The crypto market responded to Binance’s settlement and leadership change with mixed signals. Bitcoin and BNB saw initial drops but are on a recovery trajectory, indicating a cautiously optimistic market outlook. Analysts speculate that these developments could increase the likelihood of a U.S. spot-based Bitcoin ETF.

Navigating Murky Regulatory Waters

The Binance settlement underscores the complex interplay between crypto exchanges and regulatory bodies. The crypto industry operates in a rapidly evolving landscape where regulatory clarity often lags behind technological advancements. This gap has led to a fine line between innovation and compliance, requiring diligent scrutiny, review, and management.

The Binance case highlights the need for clearer regulatory frameworks that balance the need for innovation with consumer protection and legal compliance. As the industry matures, it becomes imperative for exchanges and regulatory bodies to engage in constructive dialogue, fostering an environment where all parties can prosper without compromising on legal and ethical standards.

A New Chapter for Binance and Crypto Regulation

Binance’s resolution with U.S. authorities and the ushering in of new leadership represent more than just corporate restructuring; they symbolize the crypto industry’s ongoing journey towards maturity and regulatory compliance. With a commitment to adhering to legal standards and fostering growth, Binance is set to navigate the challenges and opportunities that lie ahead in the dynamic world of cryptocurrency.